We are all quire accustomed to the need to visit an online store, choose the required product or service and then perform specific actions to pay for our purchase. This is a classical scheme. However, it is not infrequent for us to face a situation when we need to accept a random payment from a customer with no access to a POS terminal.

For example, you give private lessons or consultations. When it is time to pay for the service rendered, your customer suddenly find a bankcard to be the only means of payment available at the moment. In such situations, you could definitely benefit from invoicing, a service addressed by Bilderlings Pay in detail in today’s article.

Let us begin with the very concept. Invoicing means the issuance of an invoice by SMS or e-mail. It is available even to those who do not have their own website. In order to make things clear, let us analyse a real-life case.

In order to accept a payment, you only need to know your customer’s e-mail address or phone number. You log on to the invoicing system and create a new invoice: specify the amount to be deducted and the payer’s phone number / e-mail address. No further details are required.

Issuing an invoice will not take more than a minute. The invoice is going to reach your customer as an SMS / e-mail with a link; the customer will just have to click it, enter the payment card details, and the invoice will be paid. You will get a payment confirmation, and the money is going to be credited to your account on the next business day already.

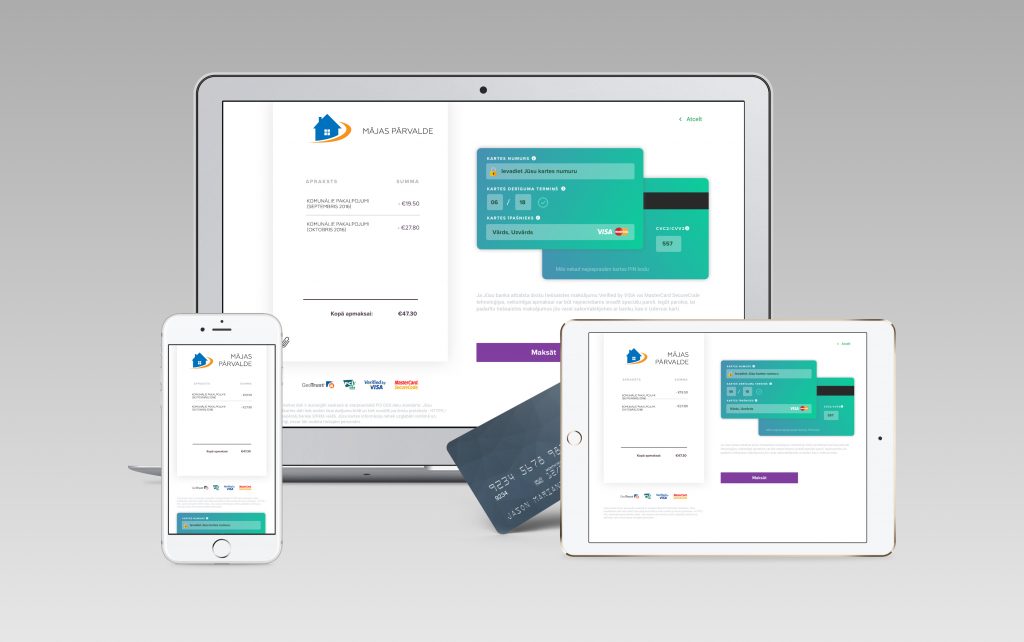

‘The invoicing has a range of extra functions. One of these is the custom invoice design. It allows altering the colour scheme of the page that requests payment card data. For example, you can choose the colours that match your corporate style‘, says the UX-design expert of Bilderlings Pay.

Another function is the automatic accrual of late fees. When you issue an invoice, you can specify a date, after which the automatic system is going to add late fees to the amount of the invoice for each day of the delay.

This service is going to be especially useful for housing service providers and credit institutions. Invoices can be issued manually or through the use of API (see the article “What is API and why one would want to connect it”).

API allows the issuance of numerous invoices in an automatic mode. For example, your accounting system draws up a list of debtors with their respective contact data and debt amounts, and the invoicing mechanism issues invoices to everyone. As soon as an invoice is paid, the accounting system is going to receive a notice thereof and make the due amendments to its base.

Integration of your accounting system and the invoicing system is very fast and simple, thanks to the need to set up just a few parameters required for the issuance of an invoice.

An invoice paid once can be set in the recurrent mode. This means that your customer would only have to pay an invoice once, and the system is going to deduct funds from the payer’s card on a regular basis from now forth. You will not have to worry about any customers who could forget to pay your services.

When issuing an invoice (with the automatic recurrent payment function), you need to specify the time intervals for the deduction of funds, e.g., once a week or once a month. There is no need to worry about inappropriate recurrent payment settings. These can be changed. The system allows reassigning the payment timelines and amounts.

Invoicing experts working with Bilderlings Pay state that this opportunity could be of much use for various service providers. For instance, prepayment schemes are essential for publishing houses (subscription to newspapers and magazines); post-payment is intensely used by mobile network operators or Internet providers.

Every time the funds are debited from the customer’s bankcard, you will be notified of the payment. Due to the opportunity to use a fully automatic payment process, this is going to save both your time and your customer’s time. Your personal account gives you access to detailed payment statistics.

Please note that the recurrent payment service is to be used with care. Make sure that the customer is aware that the payment of an invoice activates the mechanism for deducting funds from his/her bank in the future as well, according to the respective timelines set.

What is it for, and why is it so important?

First of all, if the customer is aware of the next subsequent payment made automatically on a specific date, the customer is going to replenish the card account in advance, so that the amount thereon would be sufficient for payment. At that, the customer must be interested in repeated provision (extension) of the respective service.

Second, if you withhold the information on recurrent payments from your customers, this is going to cause a number of problems: you will have less trust as a provider of goods or services, the payer may opt to contact his/her bank to revoke the unauthorised payment. The customer can also file a protest, proving that he/she did not authorise the automatic subsequent deduction of funds from the customer’s card.

To sum it up, here are the considerations confirming that the invoicing service is both simple and convenient to use:

- The key benefit of invoicing is that the only detail you need to know in order to issue an invoice is the customer’s phone number or e-mail address. If you want to issue an invoice to someone, you probably know these details already.

- There is no need to ask a customer to provide a payment card number or a bank account number. Your customer can pay the invoice from any card whenever he/she would deem it convenient.

- As we already stated above ⇑, many types of businesses could benefit from this service – housing service providers, communication operators, people who provide private services. All you have to do in order to have the due funds deducted, for instance, each week after the payment is made (e.g., subscription), is specify the respective period and amount upon issuance of the invoice. You will be notified each time the funds are deducted successfully.

- Invoices can be issued in manual or automatic mode. Setting up your system to issue invoices automatically is simple and fast.

Subscribe to our Facebook profile to stay aware of the latest news in the world of electronic commerce, and feel free to contact the experts of Bilderlings Pay if you need to set up the electronic invoicing service; we be glad to pick the best offer for you.