International payments for business

Fast cross-border payments for business

Send GBP to the UK starting from £2

From most countries worldwide to the UK

Seamless payments in US dollars are now available

Now, you can send US dollar payments to most countries worldwide. Make seamless payments: the cost is starting from 35 euros for amounts not exceeding 50,000 euros in equivalent.

Favourable payments in CNY

Make hassle-free payments in Chinese yuan. Pricing starts at 35 EUR for transactions up to 50,000 EUR.

Payments in AED

Use the most popular currency worldwide - Emirati Dirham

Want more?

Whether you need to send money to almost any part of the world or deal with niche markets, we've got you covered. If you need something else - ask us.

Favourable payments in CNY

Make hassle-free payments in Chinese yuan. Pricing starts at 35 EUR for transactions up to 50,000 EUR.

Let us unleash the full power of your business 💪

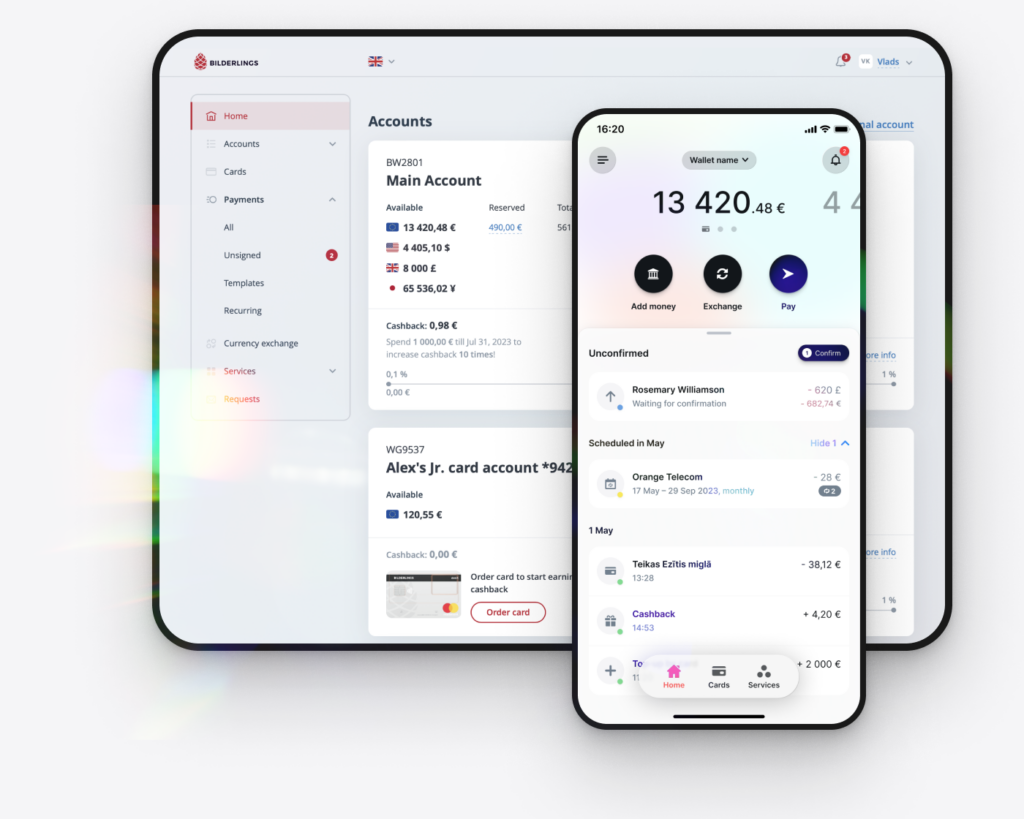

All the necessary systems for cross-border payments and a super useful set of tools are the reasons why Bilderlings makes entrepreneurs stronger

Exchange money, be flexible

We have taken care and created an ultimate, multi-currency account where you can easily receive, hold and exchange multiple currencies for all your business needs

No more borders with global payment system variety support

Pay your partners in Europe within seconds with SEPA Instant and worldwide faster using SWIFT and TARGET2

It's like being at home in the United Kingdom

Stunningly fast transfers in pounds within the 🇬🇧 UK are even easier and cheaper

Free transfers with Bilderlings partners

Instant and free money transfers between Bilderlings accounts in any available currency

Enjoy full control over your

money any time

money any time

The multi-signature feature for translations helps you feel in complete control.

Tools that help pump up

your business

💳 Virtual and plastic cards

Securely pay online and in shops, withdraw cash. Apple/Google Pay is supported.

🤖 Automate with API

Connect your account to various systems and automate the execution of transfers.

✌️ Multiple accounts

Create lots of sub-accounts to keep all your business in good order.

Quickly switch between all your companies and your personal account – everything on one screen.

✍️ Multi-signature

For example, you can give your accountant access with rights only to create payments, then you check and confirm it yourself from your smartphone.

🫰 Bulk Payments

Save tens and hundreds of hours in Bulk Payments. Just upload your list and make hundreds of payments in one go — as easy as a finger snap.

🔂 Recurring and scheduled payments

Set the date or frequency of transfer recurrence for routine payments and your smart account will do the rest.

🏦 Smart Deposits

Keep your money completely safe and earn interest. Starting from 100 € (service provided by a partner). Find out current interest rates and details.

🛟 Personal Manager and more

With the account, you get a dedicated manager who makes sure your business thrives with us. We’re constantly innovating so that you are the first to have access to cutting-edge financial tools.

Always on your side

Plenty of companies are already

with us

Fully regulated institution

Without unnecessary bureaucracy

Reasonable, transparent fees

World-class security

Experienced, multilingual team

Cutting-edge technologies empowered by AI

Questions & Answers

SEPA, SWIFT, Target2 are so-called payment channels: systems through which money is transferred from bank to bank. They differ in geography (which regions are served) and currencies.

SEPA covers the whole European Union as well as countries including Andorra, Iceland, Norway, Switzerland, Liechtenstein, Monaco, San Marino, United Kingdom, Vatican City, Mayotte, Saint Pierre and Miquelon, Guernsey, Jersey and the Isle of Man. The only currency in which SEPA transfers are possible is the euro.

With SEPA Instant, the money arrives almost instantly.

SWIFT is an internationally renowned inter-banking system, with more than 11,000 financial institutions from more than 200 countries. Bilderlings is a member of SWIFT.

TARGET2 is a European system with over 1.5 thousand banks worldwide, but is only available in Euros.

If you do not know which payment channel is more convenient and profitable for you, please contact your account manager who will be happy to advise you.

Go to your personal panel (web or mobile app), click on ‘Receive’ and select the ‘To Credentials’ option. Send the details to your counterparties and receive payment.

It is important that different details are used for European and international payments. Details for SEPA transfers (in EUR for the EEA) will be the default.

For international transfers – to receive or send money beyond Europe you must write an order. Go to “Help”, choose “Orders” and write in your free form that you need a SWIFT channel. Once this is activated, the details will appear next to the SEPA details.

Go to your personal panel (web or mobile app), click “Receive” and select the “To details” option. Send the details to the counterparties and receive the payment.

It is important that different requisites are used for European and international payments. Details for SEPA transfers (in euros for EEA countries) will be used by default.

For international transfers – to receive or send money outside Europe – you need to write an order. Go to the “Help” section, select “Orders” and write in a free form that you need a SWIFT channel. Once it is activated, the details will appear next to the SEPA details.

Payments via the SEPA Instant channel (i.e. payments in euros within the EEA) arrive instantly – the same minute, even on weekends and holidays. SEPA payments – usually within a business day. SWIFT and TARGET2 international payments normally take 2 to 3 working days, provided that the details of the payment are clear.

When it comes to international payments, different factors affect the speed of payment: sender and receiver jurisdictions, currency, the bank you send to/from, the amount of the transaction and the documents.

Our license allows for no technical limitations on the payment amount (where the payment is stopped automatically because it is “too large”). Thanks to the EMI (Electronic Money Institution) full license, we do not impose technical limits – the limits depend on the type of business and your turnover.

Safeguarding is a special procedure that ensures 100% security of our customers’ funds. Safeguarding requires that client funds are not used for business purposes and are kept in separate (segregated) accounts at EU central banks – no matter what happens, the money is considered inviolable. The financial department of Bilderlings makes sure that every cent of the client’s money is in its place every day.

There is no fee for internal payments (between Bilderlings’ accounts). As for SEPA, SWIFT, TARGET2 payments, it depends on your tariff type. NB: There is no difference between SEPA and SEPA Instant transfer fees.