Business current account

Transfer large payments

We have expertise in working with large businesses, to ensure swift and reliable online payments regardless of the amount. Payment limits are set according to the turnover and specifics of the company.

Cashback & Perks for Business

We know the cost of running a business is very high.

Start saving money and earn 0.8% Cashback on eligible card purchases! Also enjoy up to 35% savings on business travel expenses.

Mass Payouts

Save tens and hundreds of hours in Bulk Payments. Just upload your list and make hundreds of payments in one go — as easy as a finger snap.

Borderless payments

Send GBP to the UK starting from £2

From most countries worldwide to the UK

Seamless payments in US dollars are now available

Now, you can send US dollar payments to most countries worldwide. Make seamless payments: the cost is starting from 35 euros for amounts not exceeding 50,000 euros in equivalent.

Favourable payments in CNY

Make hassle-free payments in Chinese yuan. Pricing starts at 35 EUR for transactions up to 50,000 EUR.

Payments in AED

Use the most popular currency worldwide - Emirati Dirham

Want more?

Whether you need to send money to almost any part of the world or deal with niche markets, we've got you covered. If you need something else - ask us.

Favourable payments in CNY

Make hassle-free payments in Chinese yuan. Pricing starts at 35 EUR for transactions up to 50,000 EUR.

Grow your business with us

66

Thousands of satisfied customers in 66 countries

9+

9+ years of successful operation on the fintech market

2,9

2,9 hours – average time to open an account for a client

Boost your industry with Bilderlings

💳 Wholesale: increase your turnover

Use SEPA Instant payments and other channels.

Payments to/from third countries, including in third-country currencies.

Competent managers who understand the features of goods, waybills, specifications, CMR, and other supporting documentation, as well as the latest requirements for dual-use goods.

Payroll project.

🤖 E-commerce: develop your marketplace

SEPA Instant payments, security, payroll project.

Two accounts: for administrative activities and payments.

Competent technical support and a personal manager.

✌️ Logistics: save time and money

Simple and clear requirements for opening a business current account. Payments to and from third countries without technical limits, including in third-country currencies.

Personal managers who understand customs documents and the peculiarities of the transport business, including such narrow niches as shipping.

Quick conversion at favourable rates. Salary project.

💎 Gaming: get paid right away

Bulk payments via API and Mastercard debit cards.Direct connection to SEPA Instant and Open Banking API for fast receipt and sending of payments.

Integration with Noda payment system as an alternative to card payments: instant crediting to the merchant from EU customers – fast, convenient for everyone, no chargebacks.

🫰 Work with third countries

Receive and send payments to/from third countries and exchange currencies at a favourable exchange rate in your Personal Panel

🔂 Fintech: connect with comfort

Several online payment channels: SEPA, SWIFT.

Comfortable onboarding: we’re a fintech and understand, like no one else, what you need to open an online account.

Administrative activity account, client funds account in cooperation with partners, safeguarding account, and responsive support.

Currency diversity

Guaranteed cashback

with a virtual or black card

Virtual — instantly: a few taps and card is ready.

Pay online and wherever are supported!

Black — guaranteed cashback, impressive

design.

Get Paid Faster

Enjoy technology

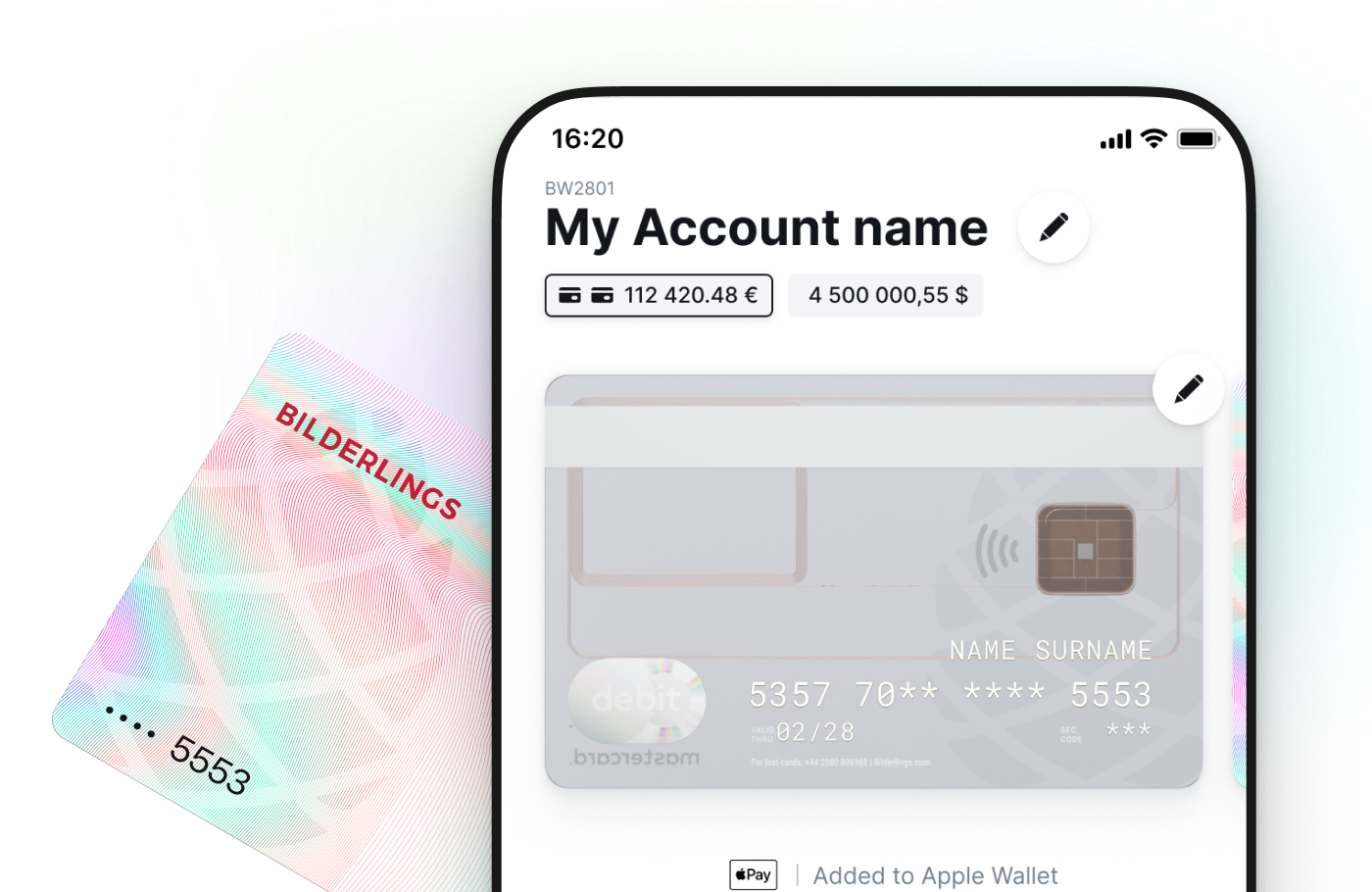

Mobile app for iOS/Android — one app for business and personal accounts. A smartphone instead of a code calculator. Multiple access to the account with differentiated rights. Switch between accounts in one click.

Manage your money around the clock

Anywhere in any currency, use your Bilderlings Mastercard contactless business card. Enhance security for your online transactions by ordering a virtual card. Payment card and delivery are included in the account opening fee.

Plenty of companies are already

with us

Be reassured your money is safe:

In accordance with the FCA’s Safeguarding requirements, our client’s funds are safeguarded which means they are protected, as funds held on behalf of our clients are held in segregated accounts and kept separately from Bilderlings own funds.

Bilderlings is reliable:

Bilderlings carefully selects and monitors the credit institutions (banks) used to hold our clients money, ensuring that they do not have any rights over the funds held in the accounts.

Questions & Answers

Many payment institutions have a technical limit on payments. Which means they can only accept a small amount as a payment. This limit does not apply to our license type – limits for your business are set individually according to the company’s turnover and type of activity.

It is a special procedure prescribed by the UK financial regulator (FCA) to protect client funds. Safeguarding means that no client money is kept in Bilderlings. Instead, it is kept in special (so-called “client money accounts”) at European Central Banks and major banks in Europe and Great Britain. These accounts are separate from other accounts and are completely untouchable.

Yes, a European company can open a business current account at Bilderlings free of charge.

Bilderlings online onboarding allows you to open a business account for a company simply by filling out an online form and uploading documents. The questions on the form and the number of documents depend on the type of business, jurisdiction, turnover, and other details.

Sometimes, if your documents fully meet the requirements and are on hand, it only takes 10 minutes to connect to an account.

On average, it takes 1-3 business days to open a business current account.

The main requirement: meet risk appetite (see the paragraph below about countries and industries we do not work with) and go through KYC, a procedure that helps us get to know you better.

The requirements vary depending on the jurisdiction, type of business, and turnover. However, the basic requirements are simple:

- no litigation involving the company;

- no connection to politically exposed people;

Bilderlings does not serve companies or individuals registered in these regions or are citizens of these countries:

Afghanistan

American Samoa

Barbados

Botswana

Burundi

Cambodia

CAR

Cuba

North Korea (DPRK)

Democratic Republic of Congo

Fiji

Guam

Iran

Iraq

Lebanon

Libya

Mali

Myanmar (Burma)

Nicaragua

Pakistan

Palau

Palestine

Samoa

Somalia

South Sudan

Sudan

Syria

Crimea (Ukraine)

Trinidad and Tobago

Uganda

Venezuela

Yemen

Zimbabwe

- Illegal gambling establishments

- Arms dealers

- Illegal drugs

- Anonymous accounts or customers who want to keep an account under a fictitious name

- Human Trafficking

- Shell Banks – that is, a bank with no physical presence or staff

- Online “adult” content, web cams, online streaming content and offensive “adult” content

- Adult content

- Sexual Assault/Hate Speech/Violence

- Copying/Copyright Infringement

Step 1. Sign up on the site – enter your email address and phone number, and create a password.

Step 2. You will receive a link in the mail and, at the same time, a code by SMS. Follow the link and enter the code.

Step 3. Congratulations! You have opened a DEMO version of your current account. You can get acquainted with your Personal panel and the basic services. If for some reason, you do not go through with the onboarding today, you will have access to the DEMO version for three months. Move on!

Step 4. Online onboarding is a 10-page questionnaire. The content of the questionnaire (i.e., the questions) depends on the data you enter: the type of your business, your field of activity, your jurisdiction, etc.

You can safely log out of the system if you need to take a break while filling out the online questionnaire or if you are missing a required document. All your data will be saved, and you will arrive at the page you previously were on when you log in again.

Contact us if you have any questions!