Business Debit cards

Boost your team with Bilderlings cards

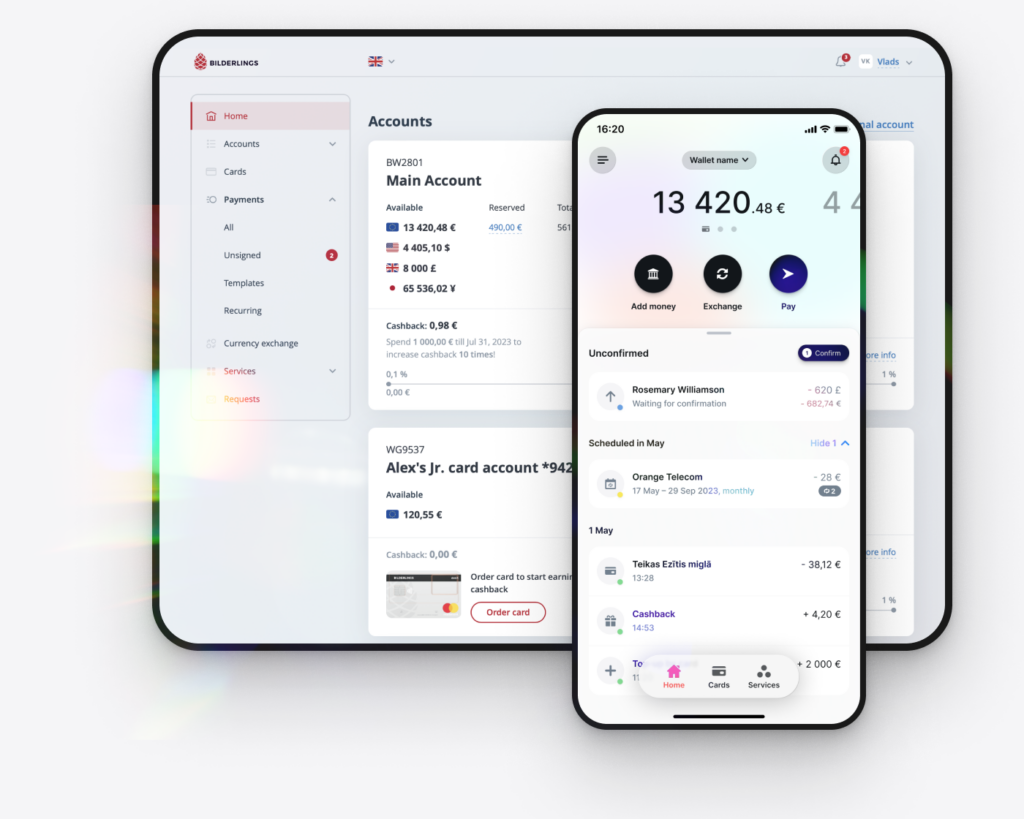

Connect the cards to the company’s main account or to separate sub-accounts and give the cards to employees

Cards that are right for your business

Choose a plastic card with fast delivery and withdraw cash worldwide or get a free virtual card in EUR/GBP/USD and pay online or with your smartphone instantly

Enjoy full control over your

cards at any time

Track your team spending and set limits in one place to feel in complete control.

Spending alerts

Get real-time spending notifications and effectively track corporate expenses using the Bilderlings app

Stay in control

Approve card payments in app instantly. Set spending on each card with the help of your personal manager

We keep your money safe

Instant and free money transfers between Bilderlings accounts in any available currency

Tools that help pump up

your business

✌️ Multiple accounts and cards

Create multiple sub-accounts and cards with their own limits for different types of spending for extra control and security

⌚ Apple Pay, Google Pay

Pay in a safe, fast way using your Apple or Android devices

🚀 Instant virtual and plastic cards

Issue a card in seconds, securely pay online and in shops, withdraw cash

🔐 Advanced security

Easily confirm payments with the Bilderlings app. Our AI-empowered security systems and 3-D Secure are there to keep you safe.

💱 Cards in different currencies

Virtual cards in EUR, USD and GBP are available for your expenses to save even more and avoid exchange fees.

Always on your side

to everyone. That's why Bilderlings delivers cards nearly everywhere.

Plenty of companies are already

with us

Fully regulated institution

Without unnecessary bureaucracy

Reasonable, transparent fees

World-class security

Experienced, multi-lingual team

Cutting-edge technologies empowered by AI

Questions & Answers

It takes three working days to manufacture a plastic card, and the rest is shipping. So the final time to receive the card depends on where the recipient is and how the card is delivered – delivery outside the European Union takes longer than within the EU.

There is no need to wait for the virtual card – it is available in your personal cabinet immediately after your order is processed.

We have two delivery options:

Priority postal delivery: usually takes between 10 and 20 days.

Courier service: here the delivery is faster, approximately 3 to 10 days.

As for the cost of delivery, for priority postal delivery cost is 5 EUR and if you choose courier service it will be 35 EUR. If it is courier delivery to Russia, Ukraine or CIS countries, the cost will be 70 EUR.

For virtual cards – you can withdraw no more than EUR/GBP/USD 3,000 at a time, no more than EUR/GBP/USD 10,000 during the day, and no more than EUR/GBP/USD 30,000 during the month.

For physical cards – you can withdraw no more than EUR 3,000 at a time, no more than EUR 10,000 during the day, and no more than EUR 30,000 during the month.

If you need to change the limits (in any direction), you need to write a free-form order in your personal panel (section “Requests”).

As many as you like. You can order a card for any employee, and you can connect it to the company’s main account, or you can open a separate one – it will also be your legal entity’s account.

For example, you need one card for the beneficiary to be able to fully dispose of the entire balance of the company: then, when ordering the card, you choose the main account of the company.

And at the same time you need a card for corporate expenses of one employee – then choose a new account and fund it from the main account. This, among other things, allows you to control the employee’s spending.

With a plastic card, you can withdraw cash, pay in stores, and pay online. It is a universal tool with two “buts”: you can lose your plastic card and have to wait a few days for a new one to be made and sent.

The virtual card exists only online: it cannot be used at an ATM or in an offline store. It’s basically just data (card number, expiration date, CVC) that you use when you make a payment.

It’s the perfect tool for online shopping – you’ll never lose this card, it will never fall into the hands of malicious parties. In addition, if you suddenly paid with it on a suspicious site and are worried about the safety of the data, you can quickly block the card and get a new one: unlike plastic cards, you do not have to wait for its issue and delivery.

Mobile Wallet: Apple Pay and Google Pay technologies allow you to connect both plastic and virtual cards to your gadget! It’s not just a way to pay at the checkout with your watch or phone; in fact, the mobile wallet extends the capabilities of a virtual card – making purchases in regular offline stores and cash withdrawal in ATMs available.

Currency: virtual cards are available in EUR, GBP, USD currencies.

Physical cards are available only in EUR.

Conversion: you can pay with the card in any country where Mastercard works, the conversion is done automatically at the Mastercard exchange rate without additional surcharges.

Conversion fee – 3%, if the currency of the card is different from the currency of the transaction.

NB If you are not in the eurozone and withdraw money in a currency other than the local currency (for example, cashing out euros in Switzerland), some ATMs may charge an additional fee.

By law they have to inform you about this before you confirm the transaction.

When withdrawing cash in the card currency EUR, you pay only the fee of Bilderlings: it is 2% (minimum – 2.5 EUR).

When withdrawing cash in the card currency GBP, you pay only the fee of Bilderlings: it is 2% (minimum – 2.5 GBP).

When withdrawing cash in the card currency USD, you pay only the fee of Bilderlings: it is 2% (minimum – 2.5 USD).

Bilderlings StartUp can assist you with company accounting, including the management of corporate card expenses.

Virtual cards are available in EUR, GBP, and USD. They can be added to Apple Pay / Google Pay mobile wallets and used just like physical cards for making purchases in stores and withdrawing cash from ATMs.

Physical cards are issued only in EUR currency.

If you want to get a card in a different currency, you can order it through your Personal Web Panel or Mobile App. This will automatically open new account.

To use the card, you must have funds on your account in the currency in which the card is issued. If you do not have funds in the required currency or not enough, you can exchange them from the available balance in another currency. This exchange can be done online 24/7 via the Mobile App or in your Personal Panel. To check the exchange rate, use an exchange calculator.