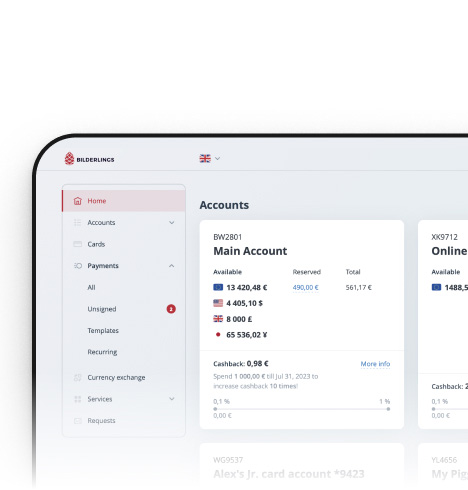

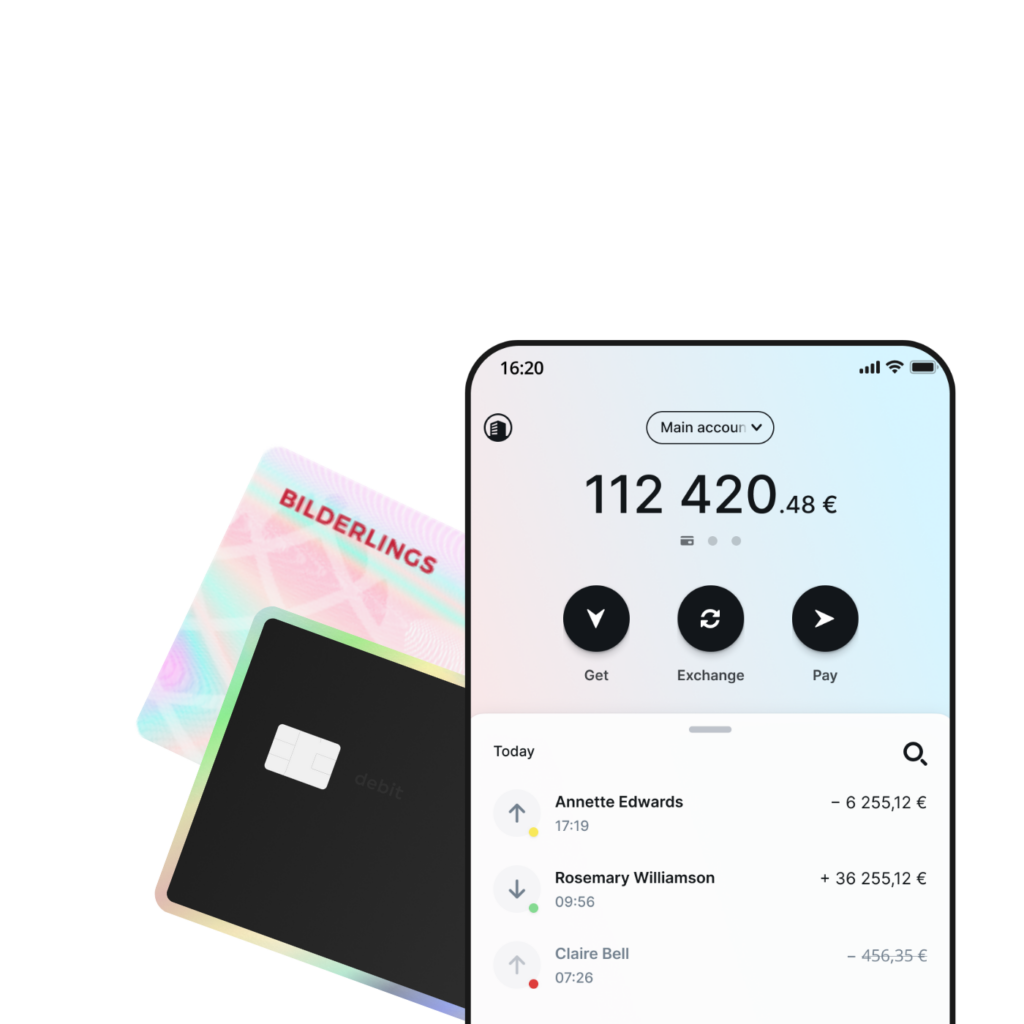

Connect with the world, pay with Bilderlings

to cutting-edge cards with guaranteed cashback,

Get more from your money

with Bilderlings

Take a look at the amazing benefits you’ll receive

Personal and business spending — available to anyone, anywhere

Available in United Kingdom and 150+ countries

Exchange, pay and get paid in a variety of currencies

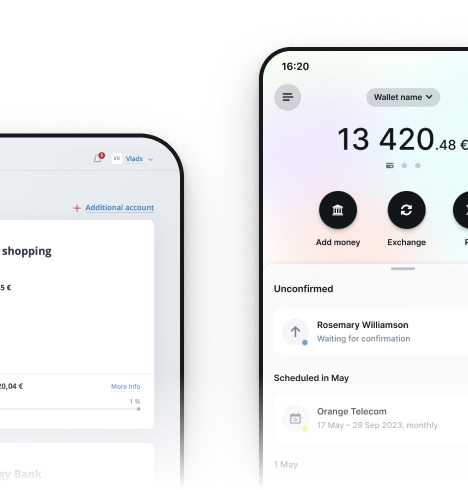

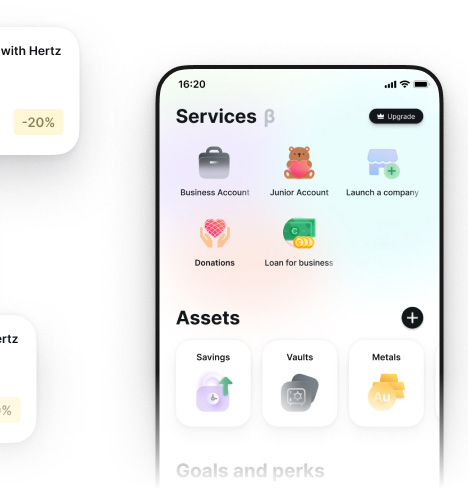

Get handy app for moving your

money on the go 🏃♂️

Send and receive money faster, use Apple Pay or Google Pay, track your cashback, and enjoy awesome perks right from the Bilderlings app

Get handy app for moving your

money on the go 🏃♂️

Send and receive money faster, use Apple Pay or Google Pay, track your cashback, and enjoy awesome perks right from the Bilderlings app.

Vault

Save effortlessly: each card transaction rounds up your spare change into your Vault automatically.

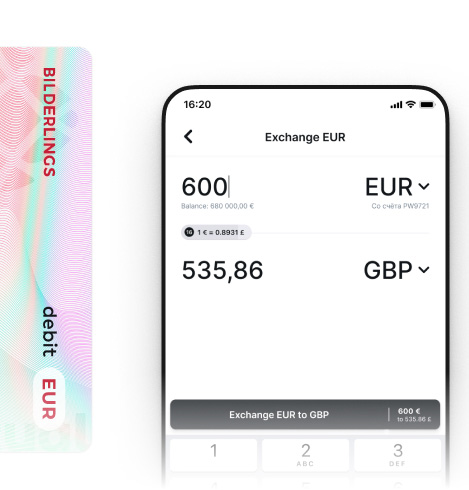

Currency exchange

Buy and sell the most popular currencies seamlessly

Savings

Safeguard your funds with reliable deposits! Enjoy up to 3.4 % annual interest, terms from 0 to 24 months. Available in EUR or USD.

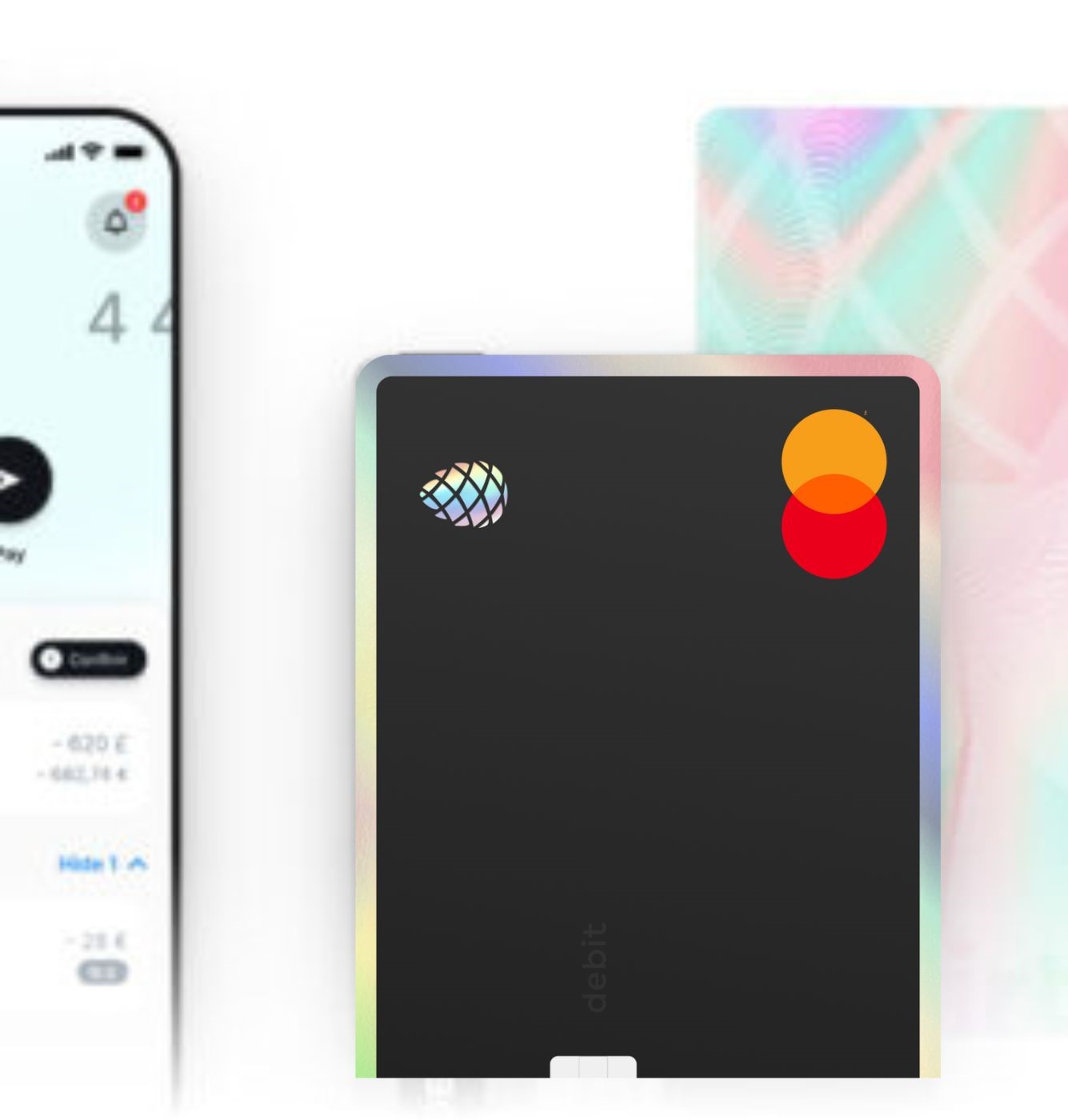

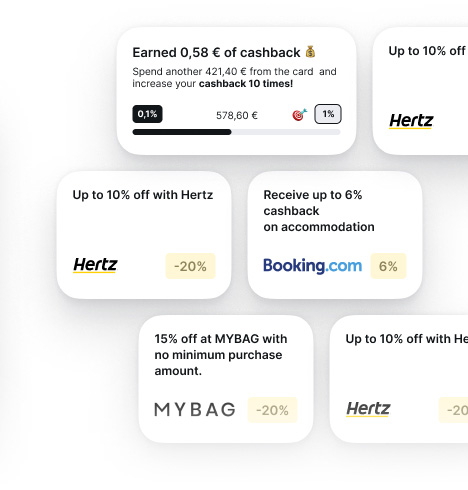

Guaranteed cashback

with a virtual or black card

Virtual — instantly: a few taps and card is ready.

Pay online and wherever are supported!

Black — guaranteed cashback, impressive

design.

Funds are safeguarded and protected

We are FCA regulated

We said goodbye to account opening fees

Don’t just take

our word for it

Don’t just take

our word for it

The card delivery was very fast. I didn’t take the express delivery, but still got my card in less than 5 working days. Thanks for the service!

I have used many different banking apps but this is one of the best. convenient clean interface, friendly support managers.

Excellent help and support for businessmen. I recommend the product with complete confidence!

Very handy app, but it took almost 24 hours to open. And I had to pay for the opening fee. Although two other banks refused to open my business at all (

Excellent payment system! I have been using it for a long time and I am very satisfied. I recommend it!

Excellent help and support for businessmen. I recommend the product with complete confidence!

Rapid, effective support; seamless communication; hassle-free global payments; user-friendly and transparent mobile application; swift deliveries. I recently requested an internationally delivered physical card…

Elena

Really good service, better than Paysera for non EU citizens. Thank you guys for your hard work!

The card delivery was very fast. I didn’t take the express delivery, but still got my card in less than 5 working days. Thanks for the service!

I have used many different banking apps but this is one of the best. convenient clean interface, friendly support managers.

Excellent help and support for businessmen. I recommend the product with complete confidence!

Very handy app, but it took almost 24 hours to open. And I had to pay for the opening fee. Although two other banks refused to open my business at all (

Excellent payment system! I have been using it for a long time and I am very satisfied. I recommend it!

Rapid, effective support; seamless communication; hassle-free global payments; user-friendly and transparent mobile application; swift deliveries. I recently requested an internationally delivered physical card…

Elena

Really good service, better than Paysera for non EU citizens. Thank you guys for your hard work!

Excellent help and support for businessmen. I recommend the product with complete confidence!

Services

Instant Open Banking Payments

Accept instant payments from Europe without chargebacks. Modern alternative to card acquiring

Bilderlings for fintech

Provide your clients with fast, secure payments and access safeguarding accounts

Open API for banking

Prioritize what truly matters through seamless account integration into any system

Launch a company

We will take care of lengthy paperwork and legal complexity, and you will get a ready-to-operate company and an access to easy-to-use financial platform

Loans for business

Expand your company’s options — receive funding to develop your company and choose custom financial solutions for your business

More than bankers —experts in your industry

We orchestrate and provide shipping transactions, financial advisory, and shipping finance to many shipowners, operators, ship brokers, agencies, and bunker traders worldwide

News

Bilderlings Pay Strategic Report 2023

This report highlights our key achievements, illustrating how we've supported our customers' success and contributed to sustainable economic growth. Explore the detailed figures and facts within to understand our journey and vision for the future.

Benefits for Business Travelers

Today, we're launching a loyalty program tailored for SME travelers. Enjoy up to 35% savings on business travel expenses, with access to over 2 million hotels worldwide, 700+ airlines, and 30+ car rental companies. More info here.

Bilderlings Annual Report 2023

146% customer growth YoY for FY23

Bilderlings mission is to propel the rapid growth of the world’s digital economy. Good Fintech meaning instant, free of charge, transparent, accessible money for everyone is our vision. Read full Annual Report here.

Where Money Does Business

Launched by industry insiders, Money20/20 is the heartbeat of the global fintech ecosystem. Be part of the global movement shaping the future of money. Let’s connect at Booth Nr. 1F136 in Amsterdam 4-6 June, 2024

The account top-up by card feature is now available again

We’re excited to inform you that you can now again top-up your account using a payment card. Easily add funds to your accounts in euros or British pounds directly through your personal web panel or mobile app. Please note that a service fee of 3% applies to each top-up amount.

Your Future Affiliate Conference #OutOfThisWorld

Join iCon on 30-31 MAY 2024 at Limassol – Cyprus. With best digital marketing professionals from across the globe in the ultimate affiliate conference of the year!

Visual identity has been refreshed

We use the full colour spectrum in its most vibrant forms. This reflects our ambition to provide customers with a wide spectrum of financial services. At the same time, Bilderlings shimmers in a different way for each and every one, reflecting our personalised approach, our flexibility, crystalline honesty, transparency and lightness.

Favourable payments in CNY

Make hassle-free payments in Chinese yuan. Pricing starts at 35 EUR for transactions up to 50,000 EUR.

Bosco Conference on May 27, 2024

Industry experts from around the world will share practical business advice and insights on growing customer and partner relationships.

Let’s meet at Limassol!

Imagine a world without trees. We can’t.

We are thrilled to announce the launch of our new initiative in support of forest restorationS, in collaboration with the Priceless Planet Coalition by Mastercard. Now, you can make an impact on forest restoration projects with just a few clicks directly from your personal web panel or Mobile App.

Mastercard Perks for Individuals

Using Bilderlings card gives not only cool perks like cashback, but also plenty of Mastercard offers are available for card holders ☘️

More info here.

Meet Us at CasinoBeats Summit!

This May 21-23, take a chance to arrange a meetup with our team and discuss hot topics for the iGaming industry. Meet us at booth B65. See you there.

Seamless payments in US dollars are now available

We are happy to announce the launch of our new payment solution for personal accounts. Now, you can send US dollar payments to most countries worldwide. Make seamless payments: the cost is 35 euros for amounts not exceeding 50,000 euros in equivalent, and 90 euros for larger payments.

Cashback for Business

Today we are launching our long-awaited cashback feature for business customers. Receive up to 0.8% on purchases with your Bilderlings card. Read more..

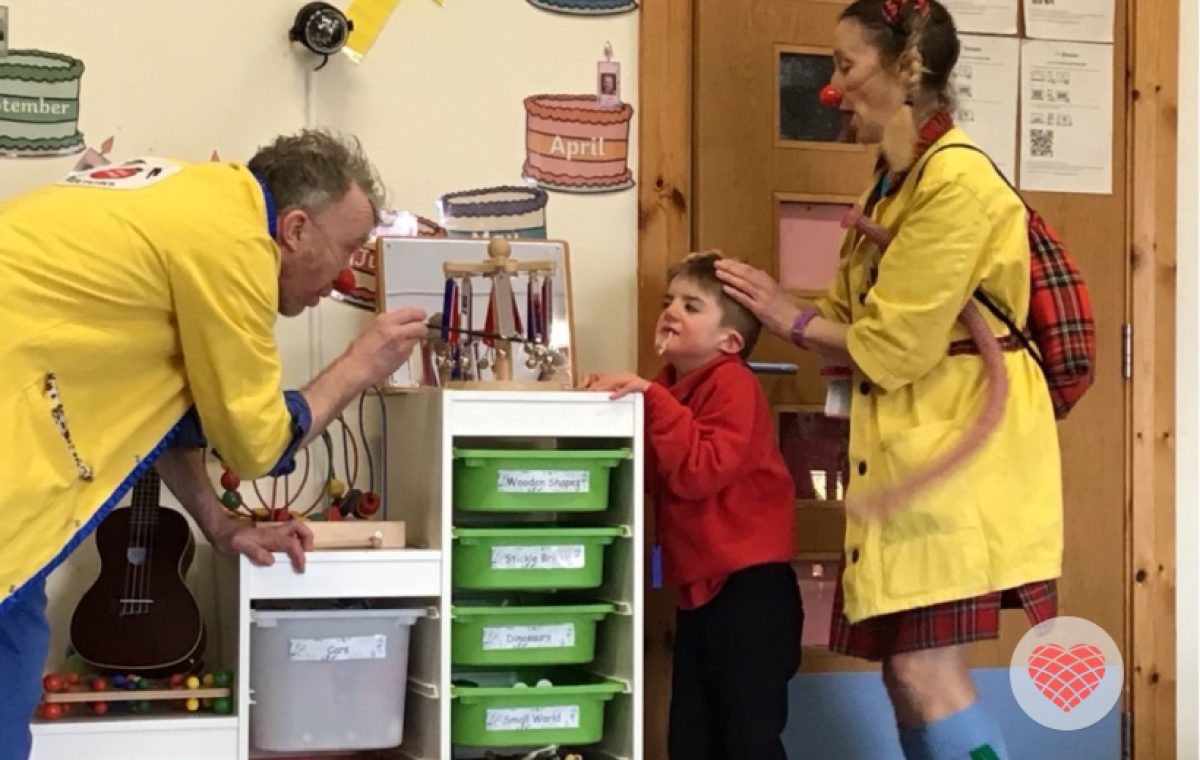

Our Clients Donated Over €12K

€12,389 has been donated using our In-App Donation Solution to support healthcare clowning. Learn more about other outcomes of the Saving Smiles project, which helps children in hospitals in the UK and Latvia.

Meet Us at TES 2024 LIS!

This February 24-27, don't miss the chance to connect with our dynamic team at TES 2024 LIS. Visit us at Booth 45 for a deep dive into thrilling affiliate business opportunities. See you there!

ICE London 2024

Mark your calendars for February 6-8, as we head to ICE London 2024, the leading event in the gaming industry. This is your perfect chance to network and get the inside scoop on the latest trends. Let's connect and explore the future of gaming together.

QR Code Payments are now available

We have successfully launched a major and highly beneficial feature: QR Code Payments! Available to all users of the latest version of our mobile app.

Free Virtual Cards in USD and GBP

Yes! We did it! Virtual cards in USD and GBP are now available. Get your new free card in your personal web panel or mobile app.

Free Account Opening for UK/EU Companies

Opening a corporate account is now free – we’ve waived the opening fee for local businesses! We believe that financial freedom should be accessible to everyone!