Bilderlings current account

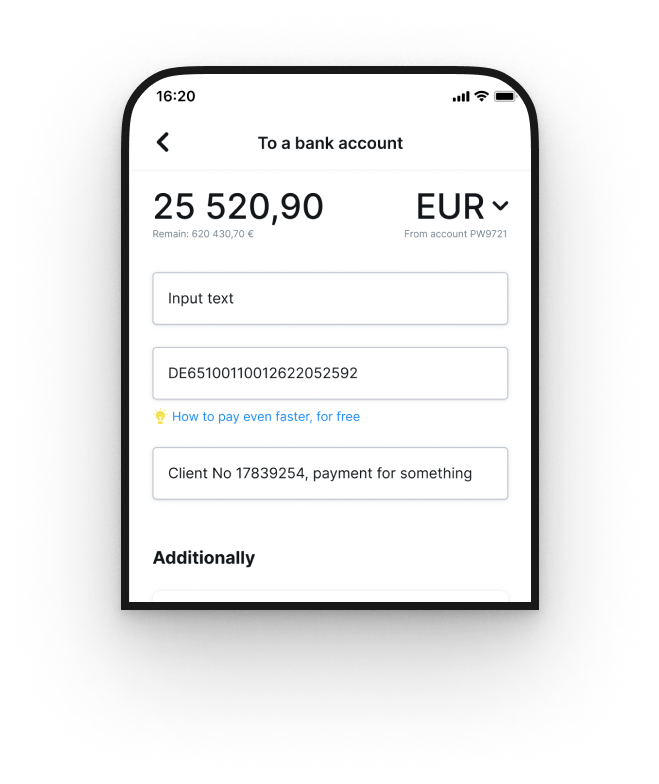

Pay and receive money faster

Multicurrency Account with IBAN details for global transfers everywhere. SEPA for Europe, SWIFT and TARGET2 worldwide.

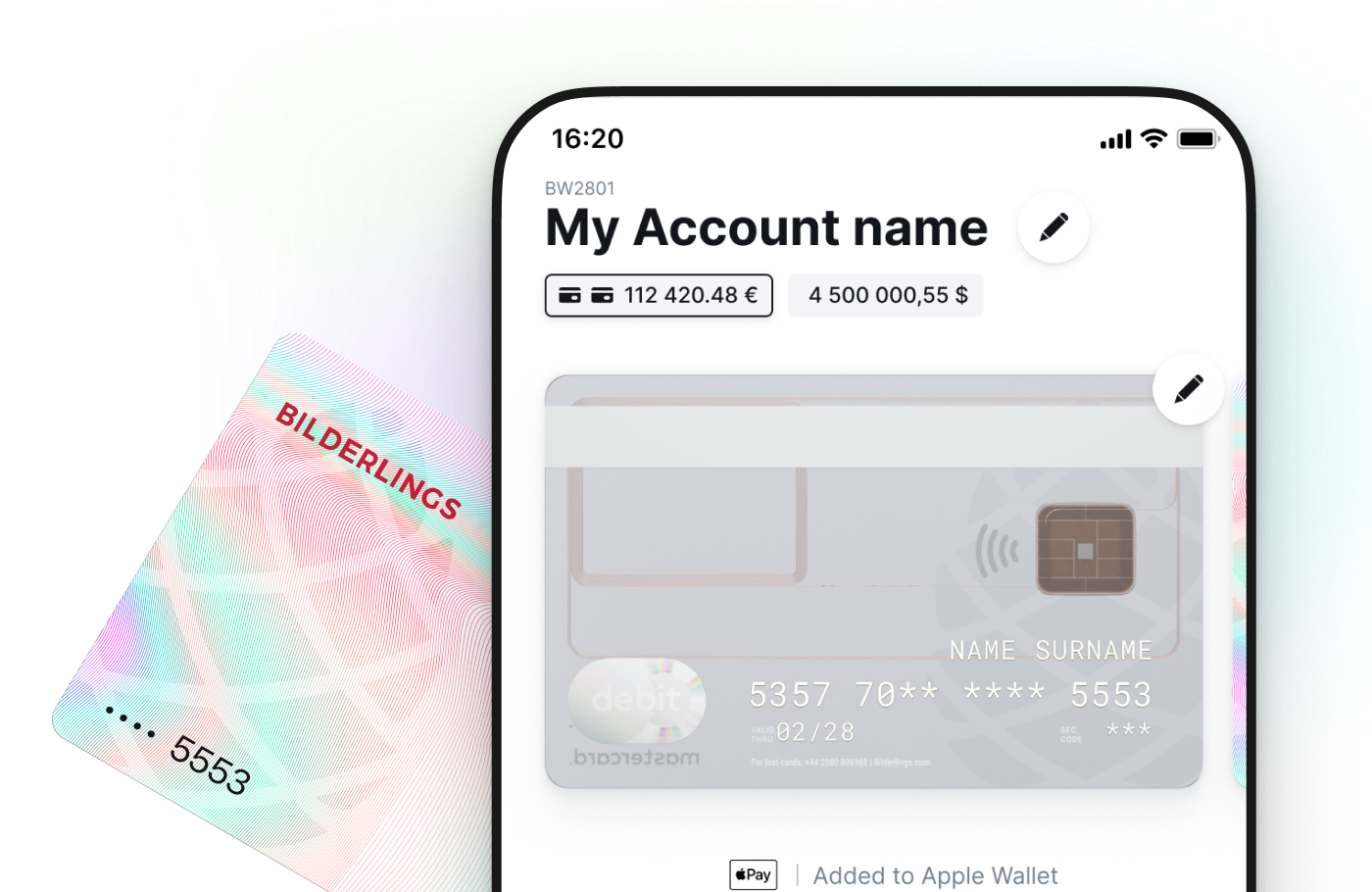

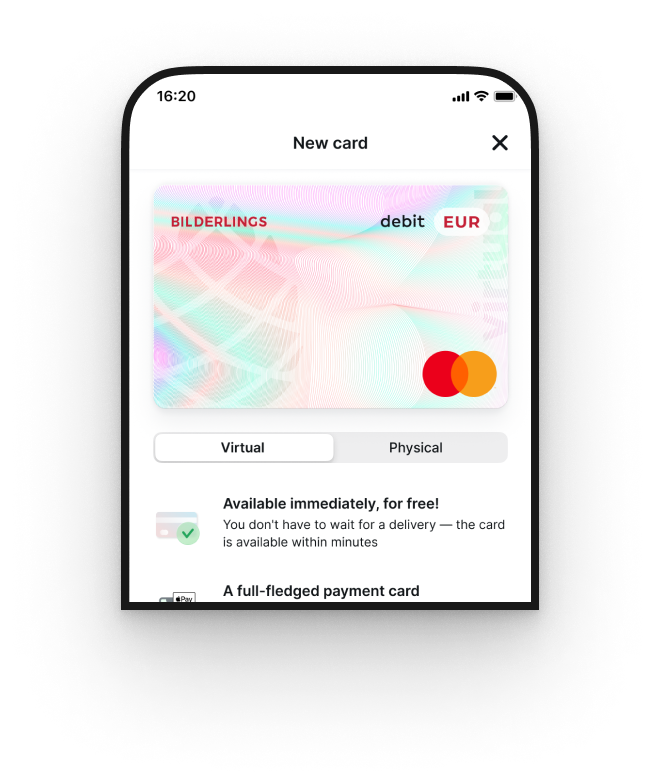

Virtual сard — yours instantly

Shop online or use Apple Pay / Google Pay. Get a card issued in EUR/GBP/USD instantly and and free of charge.

Vault

Save effortlessly: each card transaction rounds up your spare change into your Vault automatically.

You can withdraw your saved money anytime for personal expenses or use your savings to support your chosen charities.

⚡️Fast as lightning

1

Virtual card – at once

2

Transfers in seconds

3

Few taps and you can pay with your phone

Currency diversity

Send GBP to the UK starting from £2

From most countries worldwide to the UK

Seamless payments in US dollars are now available

Now, you can send US dollar payments to most countries worldwide. Make seamless payments: the cost is starting from 35 euros for amounts not exceeding 50,000 euros in equivalent.

Favourable payments in CNY

Make hassle-free payments in Chinese yuan. Pricing starts at 35 EUR for transactions up to 50,000 EUR.

Payments in AED

Use the most popular currency worldwide - Emirati Dirham

Want more?

Whether you need to send money to almost any part of the world or deal with niche markets, we've got you covered. If you need something else - ask us.

Favourable payments in CNY

Make hassle-free payments in Chinese yuan. Pricing starts at 35 EUR for transactions up to 50,000 EUR.

Available to everyone

90%

90% of accounts are opened within

2,2 hours of provision of required documentation

65%

65% of payments are performed

within 15 seconds

96%

96% of payments are performed

within 7 hours

Unlock your exclusive perks

Guaranteed cashback and perks

with a virtual or black card

Virtual — instantly: a few taps and card is ready.

Pay online and wherever are supported!

Black — guaranteed cashback, impressive

design.

Local and cross-border payments

UK current account

Deposit or savings account

Excellent exchange rates

User-friendly app

Amazing black card

Don’t just take

our word for it

Don’t just take

our word for it

The card delivery was very fast. I didn’t take the express delivery, but still got my card in less than 5 working days. Thanks for the service!

I have used many different banking apps but this is one of the best. convenient clean interface, friendly support managers.

Excellent help and support for businessmen. I recommend the product with complete confidence!

Very handy app, but it took almost 24 hours to open. And I had to pay for the opening fee. Although two other banks refused to open my business at all (

Excellent payment system! I have been using it for a long time and I am very satisfied. I recommend it!

Excellent help and support for businessmen. I recommend the product with complete confidence!

Rapid, effective support; seamless communication; hassle-free global payments; user-friendly and transparent mobile application; swift deliveries. I recently requested an internationally delivered physical card…

Elena

Really good service, better than Paysera for non EU citizens. Thank you guys for your hard work!

The card delivery was very fast. I didn’t take the express delivery, but still got my card in less than 5 working days. Thanks for the service!

I have used many different banking apps but this is one of the best. convenient clean interface, friendly support managers.

Excellent help and support for businessmen. I recommend the product with complete confidence!

Excellent help and support for businessmen. I recommend the product with complete confidence!

Very handy app, but it took almost 24 hours to open. And I had to pay for the opening fee. Although two other banks refused to open my business at all (

Excellent payment system! I have been using it for a long time and I am very satisfied. I recommend it!

Rapid, effective support; seamless communication; hassle-free global payments; user-friendly and transparent mobile application; swift deliveries. I recently requested an internationally delivered physical card…

Elena

Really good service, better than Paysera for non EU citizens. Thank you guys for your hard work!

Questions & Answers

SEPA transfers are confined to the Eurozone, exclusively dealing in EUR. They typically wrap up within a matter of seconds.

In contrast, SWIFT transfers hold a broader reach, catering to most countries globally. Such transactions take more time (spanning several working days) and incur higher costs.

Ordinarily, SEPA/SEPA Instant payments jet off and promptly land in the account. However, instances arise when payments hit a “snag.” This scenario unfolds due to incorrect or incomplete payment details. Prior to initiating a payment, please ensure that all particulars are accurately entered, leaving no fields incomplete. The clarity of payment intentions within the details is pivotal. Adhering to these guidelines ensures a smooth transaction devoid of unwarranted delays.

We extend an array of the most popular currencies for your use. Bear in mind that currency availability might vary depending on your tariff plan and other factors. For a rundown of currencies accessible to you, please visit your personal panel’s “Details” section. Should you harbor aspirations of inaugurating an account in a fresh currency, merely submit a request within your personal panel. And should supplementary queries arise, your account manager stands poised to assist.

In cases where the sending bank lacks a dedicated field for the correspondent bank, it’s essential to input this information within the “Payment details” section. It’s crucial to double-check that the payment information is accurate, as inaccuracies or incomplete details could lead to the payment’s dismissal.

For up-to-date service fees, you can always peruse our website’s “Prices” section. Moreover, remember that you’ll also find pricing information within your personal web panel.

We have certain technical boundaries for ATM cash withdrawals: you’re looking at a maximum of EUR/GBP/USD 1,000 in one go, EUR/GBP/USD2,000 per day, and EUR/GBP/USD5,000 each month. For the virtual card facilitated by MoneySend, daily withdrawals cap at EUR/GBP/USD 100, while the physical card allows for up to EUR/GBP/USD 2,000 in withdrawals.

When it comes to online or in-store purchases, we don’t impose any restrictions on our customers. As for ATM transactions, you can withdraw up to

Virtual cards – EUR/GBP/USD 1,000 at a time, EUR/GBP/USD 2,000 per day, and EUR/USD/GBP 5,000per month.

Physical cards – EUR 1,000 at a time, EUR 2,000 per day, and EUR 5,000 per month.

Additionally, the virtual card through MoneySend allows for daily withdrawals of up to EUR/GBP/USD100, while the physical card permits withdrawals of up to EUR 2,000.

To make changes to your phone number or email address, simply go to your personal web panel and write a request. There you will be able to enter your new contact details.

If you have problems accessing your personal panel, you can write a request directly to your account manager.

We have two delivery options:

Priority postal delivery: usually takes between 10 and 20 days.

Courier service: here the delivery is faster, approximately 3 to 10 days.

As for the cost of delivery, for priority postal delivery cost is 5 EUR and if you choose courier service it will be 35 EUR. If it is courier delivery to Russia, Ukraine or CIS countries, the cost will be 70 EUR.

As soon as your card is sent, you will be able to see the tracking number in your personal web panel in the “Cards” section. We also send email notification with a tracking number so that you can quickly track the card delivery.