You will forget about

- Unreasonable freezing of funds

- Limited access to banking services

- High transaction fees

- Inadequate records request

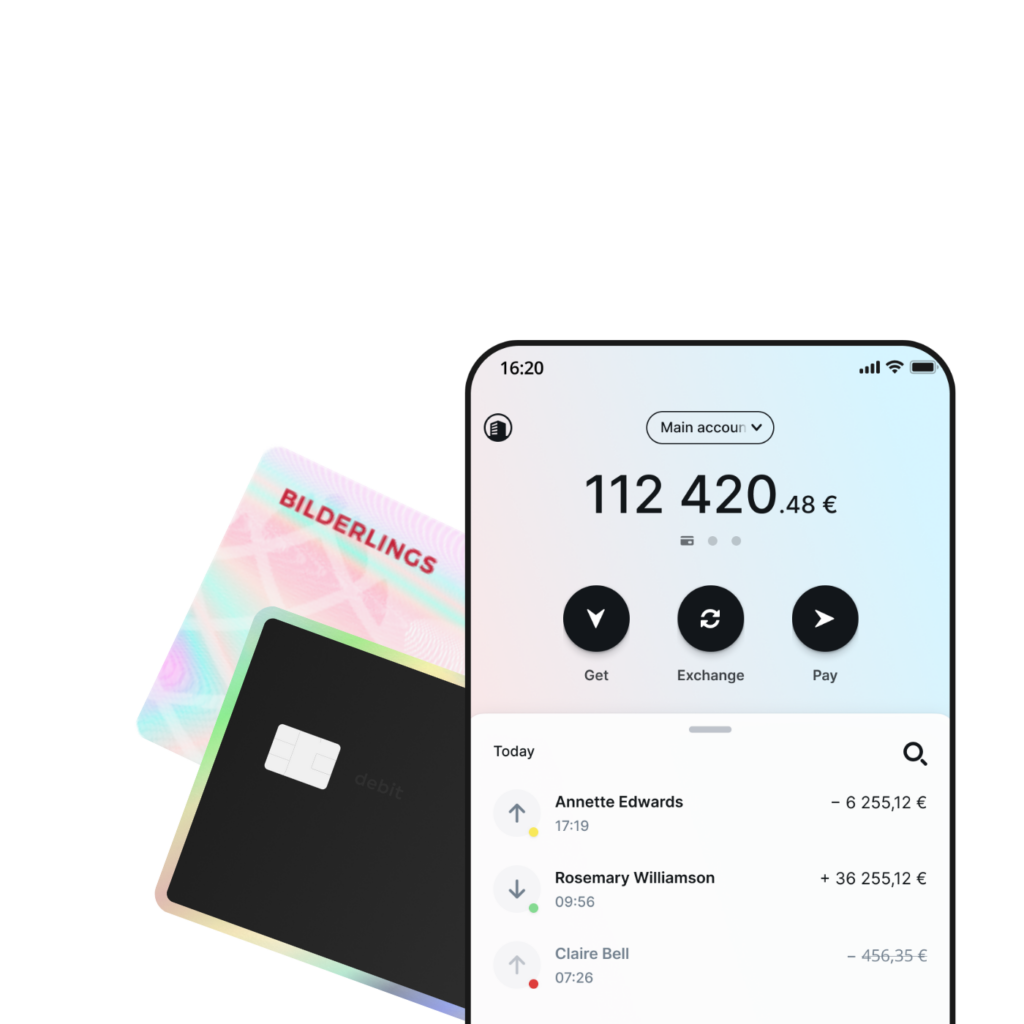

Why Choose Bilderlings?

Guaranteed access to your funds and continuity of banking services, even for high-risk profiles.

From current account to Open Banking to online acquiring, a full suite of services for high-risk industries, with 9+ years on market

Industries we work with

iGaming / Gambling

- Active License

- Transparent business ownership structure

- Detailed KYC and AML policies

Crypto

- Licence in EU

- Local presence in registration country

- Paid capital from 50k euros

Money Service businesses

- Local presence in registration country

- Detailed KYC and AML policies

- Transparent business and ownership structure

Business Legal consulting

- Proven experience in legal advisory for UBO

- Transparent business model

Dating industry

CBD industry

CBD industry

Enable your business to scale without limits

Bilderlings’ inclusive approach allows customers the freedom to choose partner jurisdictions and geographical locations for supply, provided the transactions adhere to international regulations.

Account in a Reliable Institution

460

Millions € of client funds turnover per month

We specialize in mass payments

800

Thousands of processed payments per month

We process hundreds of payments per second

190

Millions of euros in client balances

Businesses trust Bilderlings

Ready to Transform Your Banking Experience?

Questions & Answers

SEPA, SWIFT, Target2 are so-called payment channels: systems through which money is transferred from bank to bank. They differ in geography (which regions are served) and currencies.

SEPA covers the whole European Union as well as such countries as Andorra, Iceland, Norway, Switzerland, Liechtenstein, Monaco, San Marino, United Kingdom, Vatican City, Mayotte, Saint Pierre and Miquelon, Guernsey, Jersey and the Isle of Man. The only currency in which SEPA transfers are possible is the euro.

With SEPA Instant, the money arrives almost instantly – at the same second.

SWIFT is an internationally renowned inter-banking system, with more than 11,000 financial institutions from more than 200 countries. Bilderlings is a member of SWIFT.

TARGET2 is a European system with over 1.5 thousand banks worldwide, but is only available in Euros.

If you do not know which payment channel is more convenient and profitable for you, please contact your account manager who will be happy to advise you.

Go to your personal panel (web or mobile app), click on ‘Receive’ and select the ‘To Credentials’ option. Send the details to your counterparties and receive payment.

It is important that different details are used for European and international payments. Details for SEPA transfers (in EUR for the EEA) will be the default.

For international transfers – to receive or send money beyond Europe you must write an order. Go to “Help”, choose “Orders” and write in your free form that you need a SWIFT channel. Once this is activated, the details will appear next to the SEPA details.

Go to your personal panel (web or mobile app), click “Pay” and enter your payment details.

Please treat the column “Details of payment” responsibly: specify the exact purpose of the transfer (what exactly you are paying for – what service or product), the name, number and date of the document confirming the transaction.

In case of large payments and a whole package of documents accompanying the transaction, it is better to contact a personal manager in advance and provide him with all the information. This will save time in case there are any questions about the payment.

Payments via the SEPA Instant channel (i.e. payments in euros within the EEA) arrive instantly – the same minute, even on weekends and holidays. SEPA payments – usually within a business day. SWIFT and TARGET2 international payments normally take 2 to 3 working days, provided that the details of the payment are clear.

When it comes to international payments, different factors affect the speed of payment: sender and receiver jurisdictions, currency, the bank you send to/from, the amount of the transaction and the documents.

Our license allows for no technical limitations on the payment amount (where the payment is stopped automatically because it is “too large”). Thanks to the EMI (Electronic Money Institution) full license, we do not impose technical limits – the limits depend on the type of business and your turnover.

Safeguarding is a special procedure that ensures 100% security of our customers’ funds. Safeguarding requires that client funds are not used for business purposes and are kept in separate (segregated) accounts at EU central banks – no matter what happens, the money is considered inviolable. The financial department of Bilderlings makes sure that every cent of the client’s money is in its place every day.