Everyone knows how to open an account in a regular bank. At the present moment, however, and for a variety of reasons, more and more people are seeking to rely as little as possible on the familiar banking system, and turning, for example, to fintech companies, which, according to the forecasts of numerous analysts, are the future of conducting financial affairs.

If you want to open a current account to run your business in Europe quickly and easily, it is important to study the process from the inside. And the better understanding of the stages of opening an account you have, the faster the process will be. One of the biggest advantages of fintech companies in this respect is that they offer remote account opening.

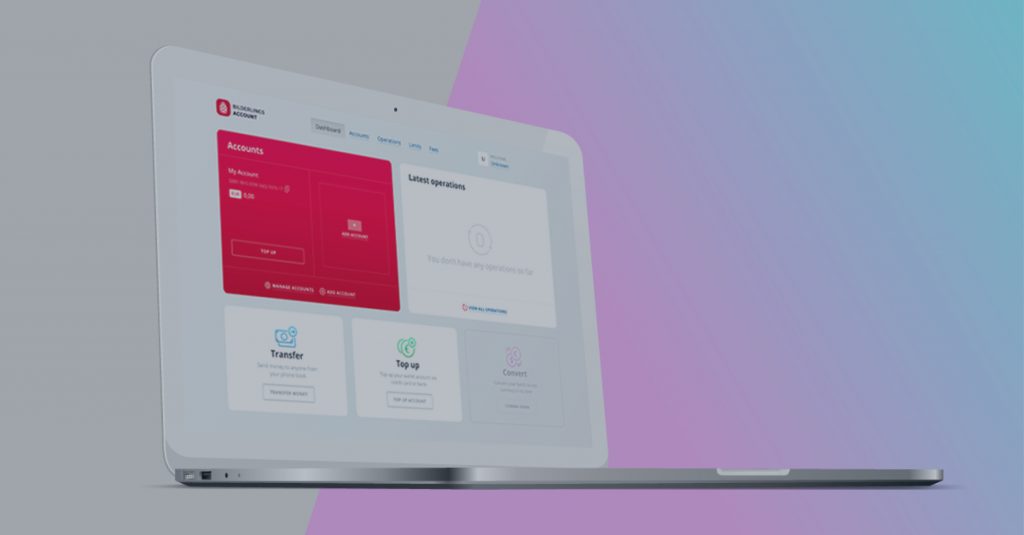

In other words, you can open an account without leaving your house, any day, any time. You simply turn on your computer, and then perform three operations — a mere three virtual steps. The first is to register; the second is to fill in a form; the third is to submit documents. And that’s it! However, in this article we will go into more detail using the example of the fintech company Bilderlings.

Step one: Register

Follow bilderlings.com/account and register. It takes less than a minute: enter your contact details and the name of your company. For our company, this is actually a signal that you are interested in the services we provide. You can also find our contact phone number and email on the site, and you can always contact us via phone and email, for example, to clarify particular details.

Step two: Fill in the form

As soon as we receive a request from a new registered user, we will immediately send a questionnaire. The form is very simple – you just need to answer a few questions about your company. It is necessary for our operators to better understand the type of business of a new customer so they can offer him the best conditions.

Step three: Submit documents

Here the most important question is: which documents are needed to open a business account in the EU? The package of documents requested from the company depends on three main issues: 1) the type of business; 2) its structure; 3) its jurisdiction.

As a rule, an entrepreneur must provide six basic documents for opening a current account.

- Verification of the company representative’s identity

To put it simply, verification is confirmation that “you are you”. We have to be sure that the entrepreneur is a real person. The client does not have to go to the office (as he would have had to do when dealing with an ordinary bank), he simply sends a selfie with his passport opened at the main page; everything should be clear and legible. And that’s it. And only in exceptional cases, an additional, or personal, identification of the client is required. However, this is extremely rare.

- Identification documents of the company’s representatives, board members, beneficiaries.

It is important to provide passport or ID-card details if the company’s representatives, members of its board or beneficiaries are EU citizens. If they have both internal and foreign passports, then it will be necessary to provide high quality photos.

- Confirmation of place of residence of the company’s representatives and beneficiaries.

To confirm your actual place of residence, you must provide either a utility bill, or a rental agreement, or an internet connection bill, in short, any document confirming the specific place of residence of a particular person. By the way, there is a nuance: for example, a bill for mobile phone service in this case is not considered a proof of residence. As you can see, everything is pretty simple. Let’s move along.

- Proof of the welfare of the beneficiary of the company.

Any property of the client, a certificate of inheritance or a document proving that he has a deposit in a particular bank can serve as such proof.

- Confirmation of the origin of funds of the company’s beneficiary.

In essence, this is information about income, for example, information about salary, dividends, agent’s commission or information about other sources of funds.

- Documents confirming cooperation with main partners.

This is the last set of documents. Here we are talking about, say, contracts, invoices, or bills of lading confirming a particular transportation of goods that was conducted in the course of the client’s business activities in a particular country.

One important detail. Our company, for example, accepts documents in English and Russian. If a client has documents in another language, then translation certified by a notary is important.

As soon as you have sent in all of the documents, Bilderlings specialists begin checking them right away. Usually this takes no more than one or two working days. After that, the client is informed of the opening of an account. If a client provided a full package of correct documents, then his account is opened very quickly – within one or two days.

Would you like to open an account right now – or do you have questions? If so, you can always contact a Bilderlings consultant who will respond as quickly as possible and, of course, will gladly help.

By the way, earlier Bilderlings discussed in detail what facts should be taken into account when choosing a partner for opening a current account.

Subscribe to our page on Facebook to stay up-to-date on the latest news from the world of Fintech, and also contact Bilderlings‘ specialists and we will find the best offer for you.